Silchuk Factoring

When Freight Moves, Money Flows

Silchuk Factoring

When Freight Moves, Money Flows

Unbeatable Rates

low as 0.7% of your invoice value, unlocking faster funding and unmatched flexibility.

Partners

Expertise

Approach

Agreements

Coverage

Credit Network.

documents

approved

same-day

Who Needs Freight Factoring?

Whether you’re waiting on slow broker payments or looking for a more transparent factoring partner, our program provides immediate funding without hidden fees or reserves.

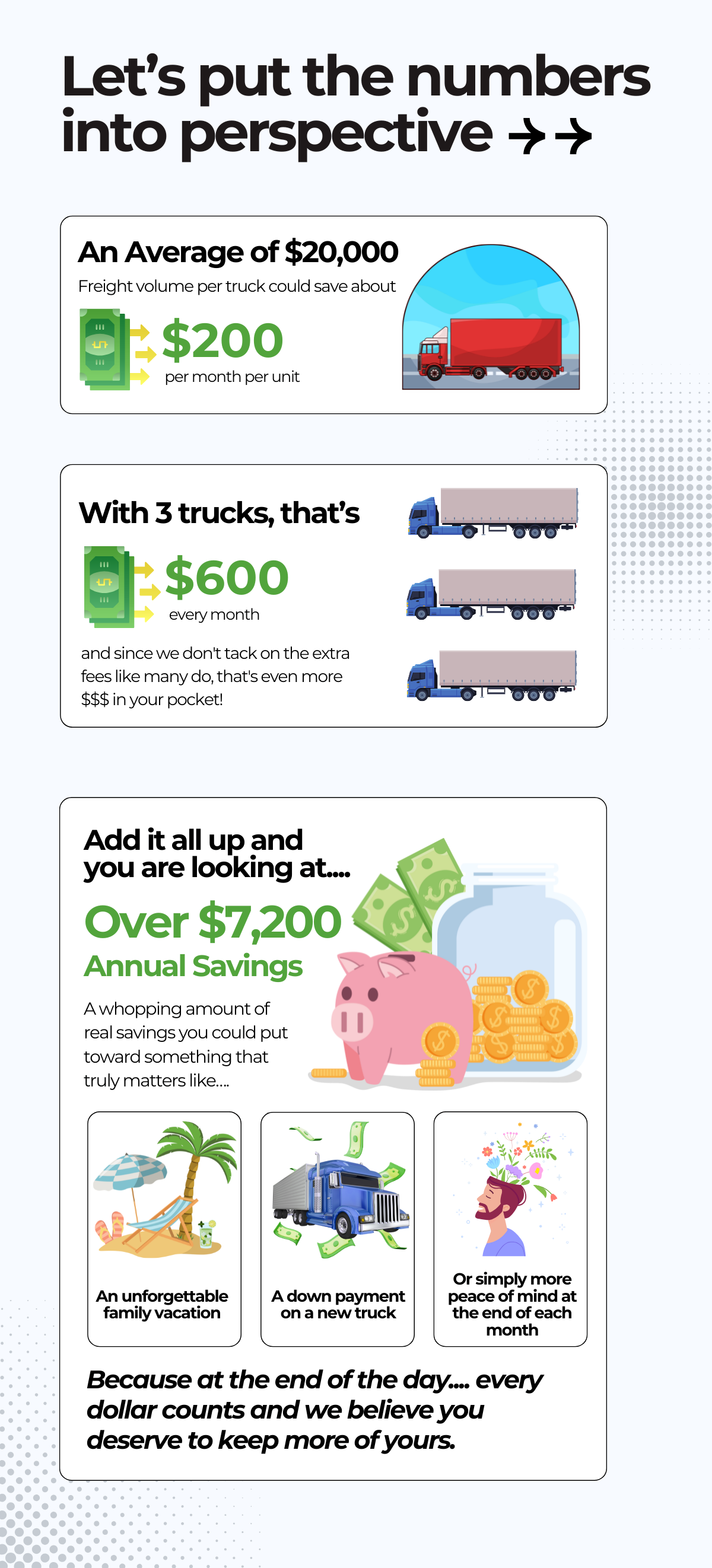

Factoring Savings Calculator

The chase for the lowest factoring rate ends here.

Get mind-blowing factoring rates, our factoring savings calculator says it all.

Calculations provided by this tool are estimates for illustrative purposes only and do not constitute a binding offer. Actual savings may vary based on factors such as total invoice volume, payment terms, client credit quality, and additional service fees. Please contact a Silchuk representative for a personalized quote.

At Silchuk, we use our industry relationships, buying power, and reputation to connect trucking companies with multiple factoring vendors, not just one. You get real options, and we help you find the partner that fits your business best.

Your business never stops moving and neither do we. Our team is known for hands-on, responsive support built for the people who keep the world moving.

Every client is paired with a dedicated Account Executive who tracks your account daily, resolves payment issues fast, and keeps your cash flow on track.

Because when you’re on the road, you deserve more than just funding, you deserve a partner that moves with you.

Frequently Asked Questions (FAQs)

Not at all, freight factoring isn't a loan, a factoring company advances you most of that amount right away (minus a small fee). There's no debt, no interest, and nothing to pay back. Once your customer pays, the transaction is complete.

Think of it as turning your invoices into instant cash flow instead of waiting weeks for payment. Unlike a traditional bank loan:

- It's faster. Get paid the same day instead of waiting for approvals.

- It's flexible. No long-term repayment schedules or credit checks.

- It gives you control. Use your cash however you want, no restrictions attached.

In short, factoring isn't borrowing, it's unlocking the money you've already earned.

We currently specialize in the trucking industry, but can evaluate unique cases through our trusted factoring partners.

Underwriting usually takes up to 5 business days. In many cases, especially for new companies with a clean record, approvals can happen in as little as 2 business days. Once approved, your company can start factoring immediately and receive funding for your invoices without delay.

Yes! Factoring helps new and established trucking companies get fast cash from unpaid invoices, no credit history needed. Approval depends on your customers' credit, making it a smart way to keep your cash flow steady, whether you're just starting out or growing your fleet.

Factoring rates depend on your load size and volume, but it's not just about the rate. With freight factoring, you also get back-office support, broker credit checks and detailed reporting, all designed to keep your trucking business moving forward.

If you're a carrier or a broker (in special cases) with active authority and creditworthy clients, you're already on the road to qualifying. Our onboarding team and flexible factoring options make it easy to get rolling fast.

Not at all. The process is straightforward. You'll need to submit your AGING report (book of business for the last completed monthly cycle), complete a short application, and provide the following documents:

- Articles of Incorporation

- Owner's Driver's License

- Signed W-9 Form

- Insurance Certificate

- Voided Business Check (for funding deposits)

Once submitted, the underwriting and eligibility process begins.

That's all you need! We keep it simple and fast.

**If your freight requires different paperwork, we will discuss and help you throughout the process.

During underwriting, we review a few key aspects to confirm eligibility:

- Your business is actively generating invoices.

- You're delivering to credit-worthy customers (brokers/shippers).

- Your customers have strong payment histories.

- Your business doesn't have significant legal or tax issues.

- For trucking and fleet businesses, we check the number of active customers, typical payment cycles, and overall stability.

We currently focus on standard freight loads. Specialized categories like car hauling, livestock, HAZMAT, or flammables may require additional review.

A buyout is when a client moves their receivables from one factoring provider to another. It's more complex than standard onboarding because it involves:

- Reviewing existing contracts

- Coordinating with the previous factoring company

- Ensuring proper release of receivables and debtor notifications

At Silchuk, we handle this process end-to-end, ensuring a smooth, secure, and transparent transition, no matter your fleet size or book of business.

Ready to Learn More?

Discover how freight factoring can transform your trucking business. Get in touch with Silchuk Factoring today to see how much cash flow you can unlock.